Please carry the QR code sent via email to the event for registration.

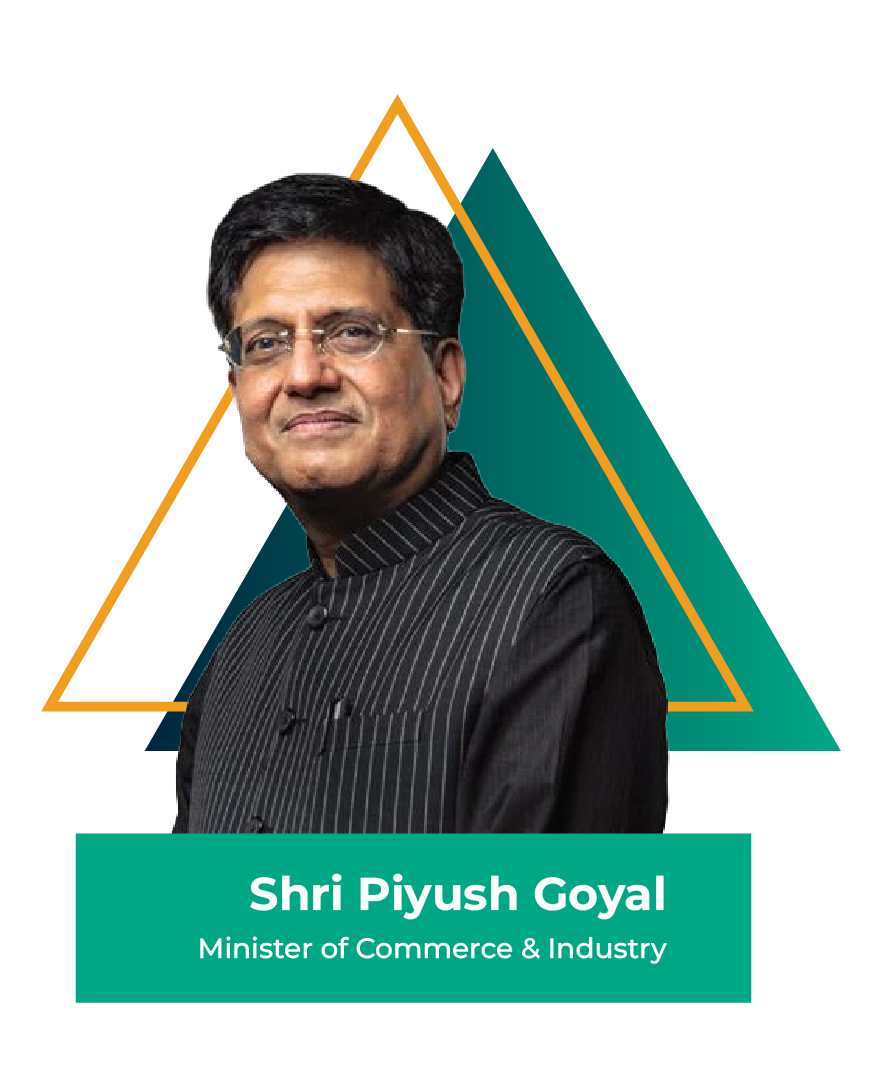

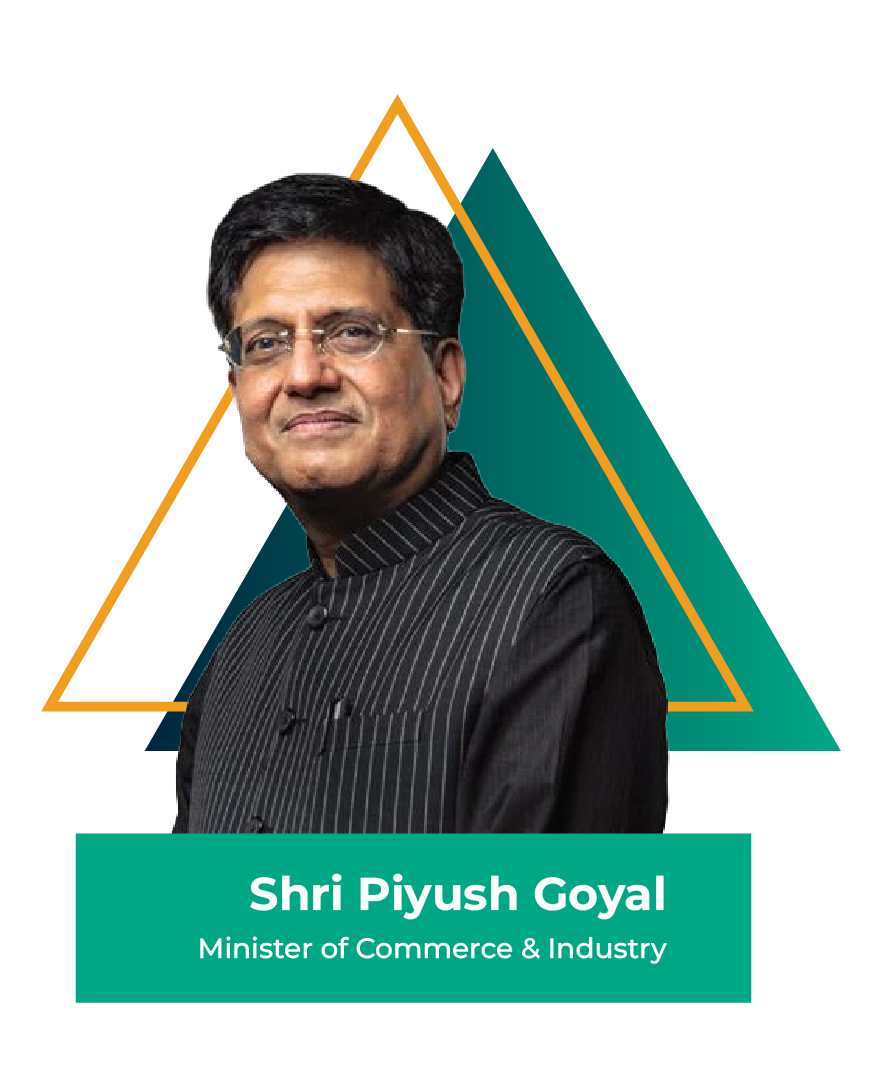

Piyush Goyal (60) is the Union Minister of Commerce & Industry and Member of Parliament, North Mumbai Lok Sabha. He has previously served as the Leader of the House in Rajya Sabha and helmed the Ministry of Consumer Affairs and Food & Public Distribution, Textiles, Railways, Finance, Corporate Affairs, Coal, Power, New & Renewable Energy, and Mines.

KEY MILESTONES UNDER HIS TENURE:

India clocked its highest-ever exports of about $776 Bn in 2022-23

Led the signing of a Free Trade Agreement (FTA) with UAE, the fastest-ever negotiated FTA globally, & India-Australia Economic Cooperation and Trade Agreement (ECTA), India’s 1st agreement with a developed country after a decade

Oversaw the launch of Production Linked Incentive (PLI) Schemes to boost Make In India

Led the implementation of the world’s largest food security program, Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) by distributing free foodgrains to nearly 80 crore poor and vulnerable people over a 2-year period

As Minister of Railways, helped India achieve the best-ever safety record of zero passenger deaths in rail accidents

As Power, Coal, and New & Renewable Energy Minister, successfully implemented the world’s largest LED bulb distribution program (UJALA)

Was awarded the 4th Annual Carnot Prize in 2018 in recognition of pathbreaking transformations in India’s energy sector by making energy efficiency a people’s movement. Carnot Prize is the most prestigious award in the energy sector given by the Kleinman Center for Energy Policy at the University of Pennsylvania for distinguished contributions to energy policy through scholarship or practice.

Arundhati Bhattacharya is the Chairperson and Chief Executive Officer, Salesforce - India & South Asia. In her role, Arundhati oversees the growth strategy of the company and plays an integral role in defining Salesforce’s relationship with the ecosystem of customers, partners, and community across India. Recently honored with the Padma Shri, one of India’s highest civilian awards by the Government of India, for her contributions to Trade and Industry, she brings a legacy of leadership, innovation, and impact.

Prior to Salesforce, she made history as the first woman chairperson of the State Bank of India (SBI), where she led the bank’s digital transformation, reinforcing its position as a forward-thinking financial institution.

With over 40 years of experience in India’s financial sector, spanning diverse national and international roles, Arundhati has earned numerous accolades, including recognition among "The World's 100 Most Powerful Women" by Forbes, “Top 50 Globally Most Powerful Women in Business”, and the “World’s 50 Greatest Leaders” list by Fortune.

India Today magazine ranked her 19th in India's 50 Most Powerful People of 2017, and she was inducted into the Hall of Fame of Business Today’s Most Powerful Women in Business—an exclusive club reserved for seven-time winners of the MPW awards.

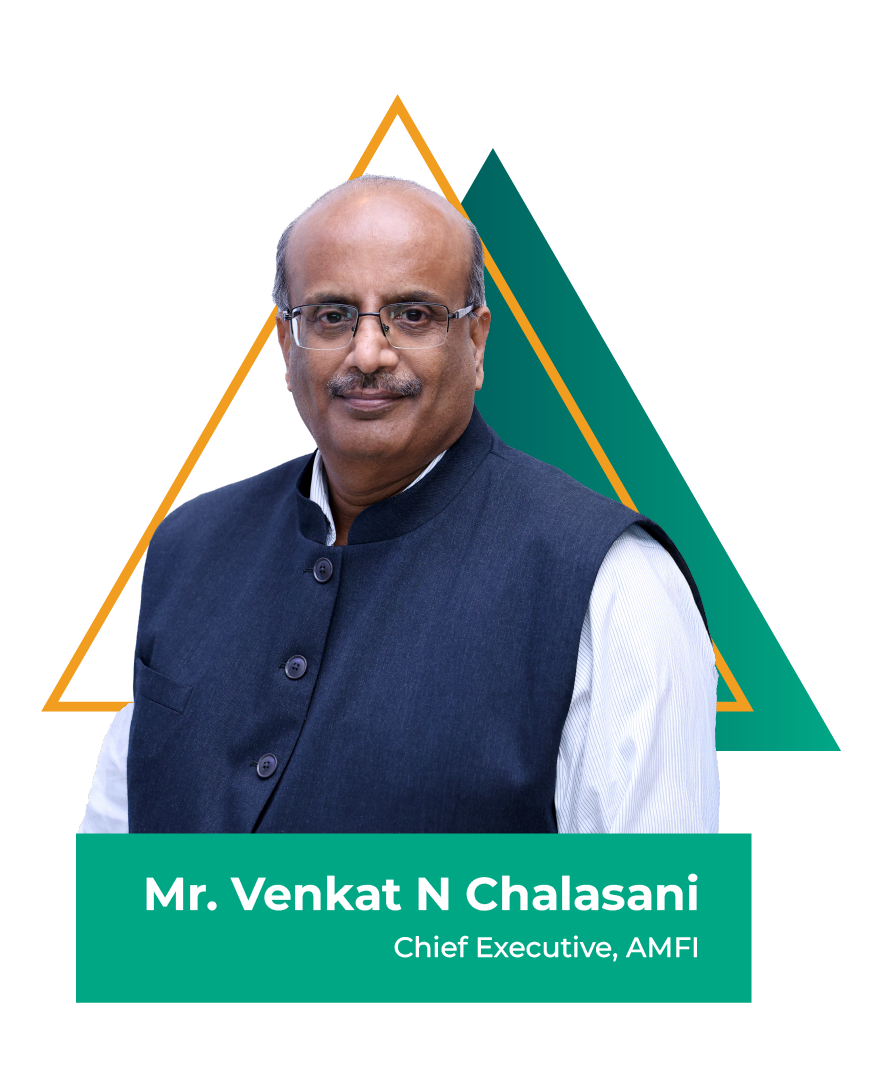

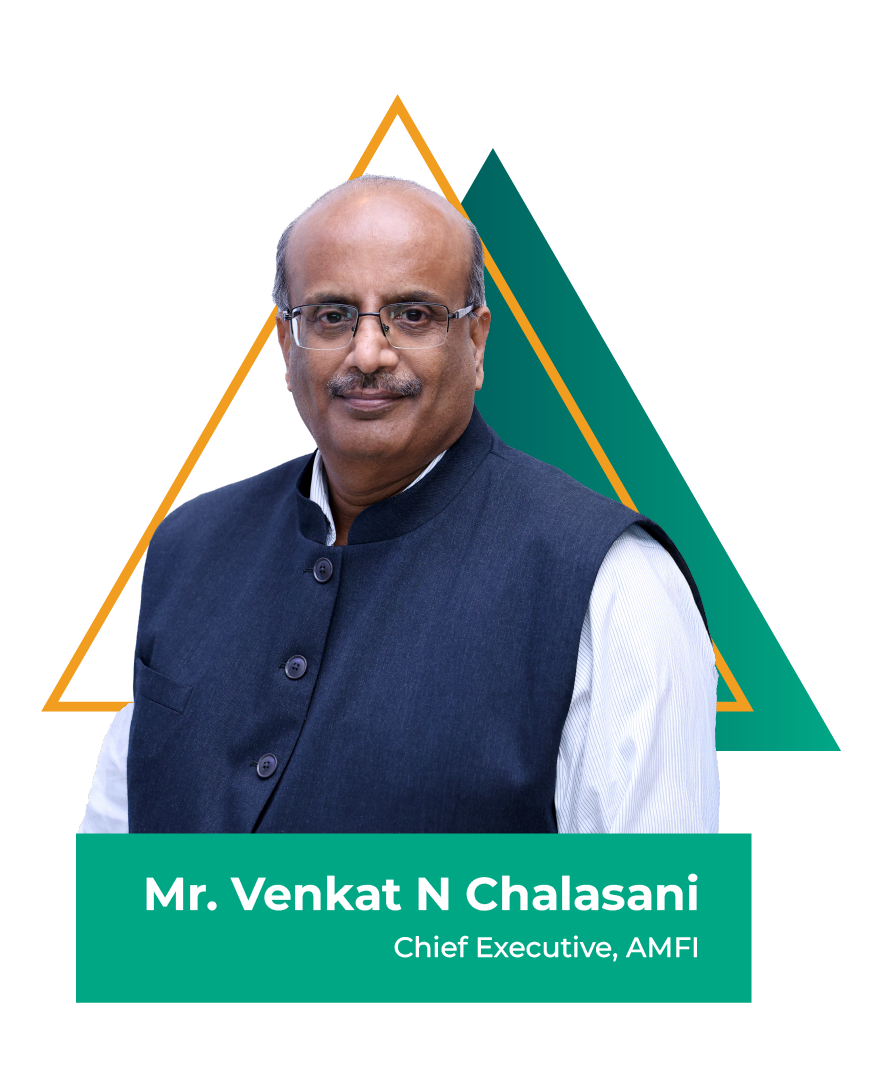

Mr. Venkat Nageswar Chalasani has a wealth of expertise and experience of nearly four decades . Prior to this, he served as the Deputy Managing Director at the State Bank of India, India's leading financial institutions, where he had long and successful career. He has also held various board positions and has been part of committees’ set-up by Reserve Bank of India and Ministry of Finance and Ministry of Trade & Commerce.

Navneet Munot is the MD & CEO of HDFC Asset Management Company Limited (HDFC AMC). He joined the firm in February 2021. HDFC AMC manages over Rs.7.75 lakh crore across Equity and Fixed Income Mutual Funds for over 1 crore investors across the country. Navneet is also the Chairman of the Association of Mutual Funds in India (AMFI).

A veteran of financial markets, Navneet has 3 decades of rich experience in the industry. Prior to joining HDFC AMC, he was the Executive director and Chief Investment officer of SBI Funds management Private Limited and was responsible for overseeing AUM over USD 150 billion across mutual funds and segregated accounts. Navneet was also a Director on the board of SBI Pension Funds (P) Limited.

In prior assignments, he was the Executive Director & Head – multi-strategy boutique with Morgan Stanley Investment Management and Chief Investment Officer – Fixed Income and Hybrid Funds at Birla Sun Life Mutual Fund.

Mr. Amarjeet Singh, is presently the Whole-time Member at Securities and Exchange Board of India (SEBI). With a career spanning nearly 3 decades with SEBI, he has extensive experience in development, regulation and supervision of securities markets.

Mr. Singh has been instrumental in introducing SEBI’s reforms in both primary and secondary securities markets including areas of Initial Public Offerings, Corporate Governance, Stewardship, Financing Reporting, T+1 Settlement and Risk Management. He has led SEBI’s engagements on sustainability reporting in recent years and also the conceptualization and formation of Social Stock Exchange and its related ecosystem in India.

Mr. Singh is currently a member on the Board of the International Ethics Standards Board for Accountants (IESBA). He has represented SEBI on numerous Committees set up by Reserve Bank of India and Government of India. He was a part-time member on the Board of the National Financial Reporting Authority (2019-2022) and on the Board of Governors of the Indian Institute of Corporate Affairs (2019-2023), set up by the Ministry of Corporate Affairs. He has also served on the Board of the National Institute of Securities Market.

Mr. Singh has been involved in various international regulatory initiatives, including that of International Organization of Securities Commissions (IOSCO). He has acted as Sherpa for SEBI’s representation on the Board of IOSCO. As former Chair of the Assessment Committee of IOSCO (2016-2018) and member of its various policy committees since 2010, he has steered thematic assessments at the global level and contributed to the evolution of IOSCO Principles and Standards.

Apart from an MBA, Mr. Singh holds a Master’s degree in Economic Policy Management from Columbia University, NY, USA. He is a recipient of the Rotary Foundation Educational Award, 2000 for promoting leadership development and international understanding by Rotary International, USA and of the Joint Japan – World Bank Graduate Scholarship Award, 2001 – 02.

Navneet Munot is the MD & CEO of HDFC Asset Management Company Limited (HDFC AMC). He joined the firm in February 2021. HDFC AMC manages over Rs.7.75 lakh crore across Equity and Fixed Income Mutual Funds for over 1 crore investors across the country. Navneet is also the Chairman of the Association of Mutual Funds in India (AMFI).

A veteran of financial markets, Navneet has 3 decades of rich experience in the industry. Prior to joining HDFC AMC, he was the Executive director and Chief Investment officer of SBI Funds management Private Limited and was responsible for overseeing AUM over USD 150 billion across mutual funds and segregated accounts. Navneet was also a Director on the board of SBI Pension Funds (P) Limited.

In prior assignments, he was the Executive Director & Head – multi-strategy boutique with Morgan Stanley Investment Management and Chief Investment Officer – Fixed Income and Hybrid Funds at Birla Sun Life Mutual Fund.

Mr. Manoj Kumar, Executive Director, SEBI Has been associated with Securities and Exchange Board of India (SEBI), a premier autonomous regulatory body for securities market in India, for more than 27 years.

He is currently as an Executive Director, heading the Investment Management Department of SEBI. He has earlier handled Market Regulations, Integrated Surveillance, Market Intermediaries Regulation and Supervision Departments at SEBI.

He has been associated with key SEBI initiatives such as Accounting Standards Committee chaired by Y H Malegam, Corporate Governance Committee chaired by Narayana Murthy. He has been the Member of the core group that successfully designed and implemented Integrated Market Surveillance System. Currently, he is a member secretary of the Mutual Funds Advisory Committee (MFAC).

He has also worked at IFSCA as an Executive Director.

He holds a postgraduate in Science and MBA.

Navneet Munot is the MD & CEO of HDFC Asset Management Company Limited (HDFC AMC). He joined the firm in February 2021. HDFC AMC manages over Rs.7.75 lakh crore across Equity and Fixed Income Mutual Funds for over 1 crore investors across the country. Navneet is also the Chairman of the Association of Mutual Funds in India (AMFI).

A veteran of financial markets, Navneet has 3 decades of rich experience in the industry. Prior to joining HDFC AMC, he was the Executive director and Chief Investment officer of SBI Funds management Private Limited and was responsible for overseeing AUM over USD 150 billion across mutual funds and segregated accounts. Navneet was also a Director on the board of SBI Pension Funds (P) Limited.

In prior assignments, he was the Executive Director & Head – multi-strategy boutique with Morgan Stanley Investment Management and Chief Investment Officer – Fixed Income and Hybrid Funds at Birla Sun Life Mutual Fund.

Mr. Nilesh Shah, Group President & Managing Director, Kotak Mahindra Asset Management Company (KMAMC)

Nilesh lead his team to the Best Fund House of the Year Award at all the mutual funds where he has worked viz. Kotak, ICICI Prudential and Franklin Templeton Mutual Fund.

Nilesh is a part time member of the Economic Advisory Council to the Prime Minister. He is a part time member of Unique Identification Authority of India (UIDAI). He is a member of the Board of Association of Mutual Funds in India and a Member of CoBoSAC committee of SEBI.

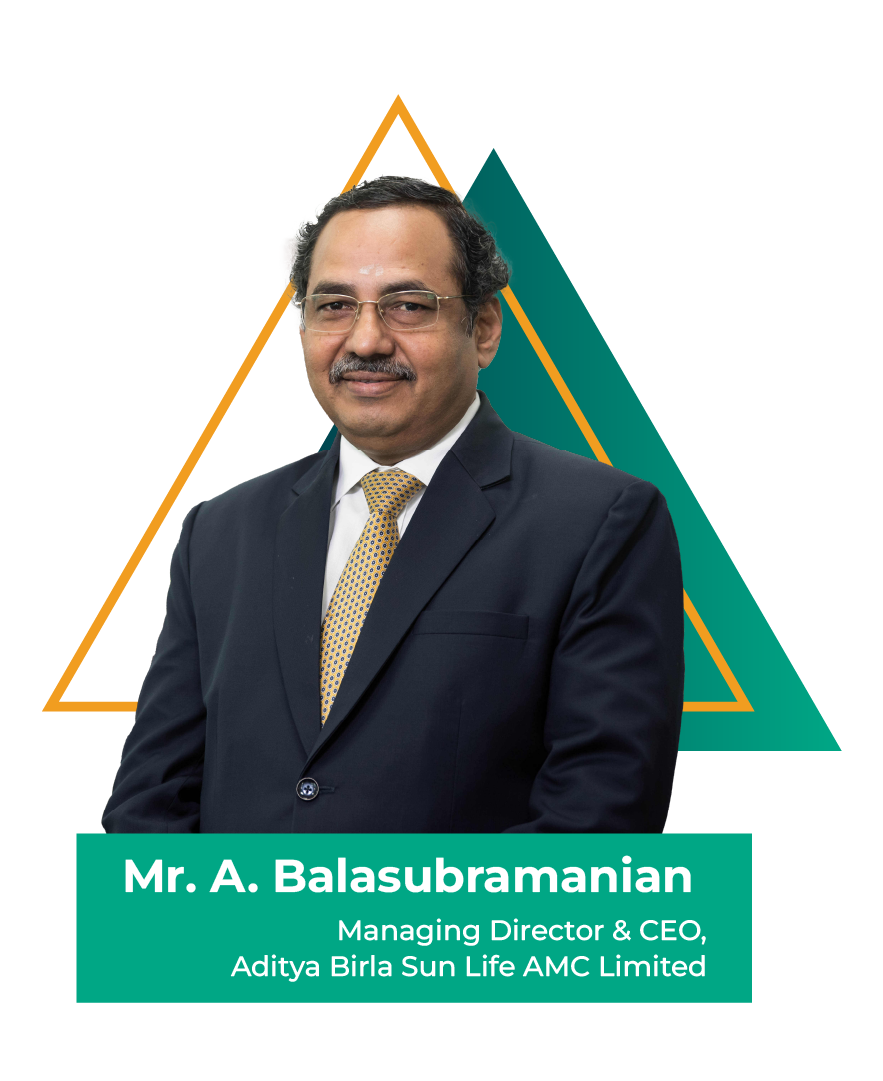

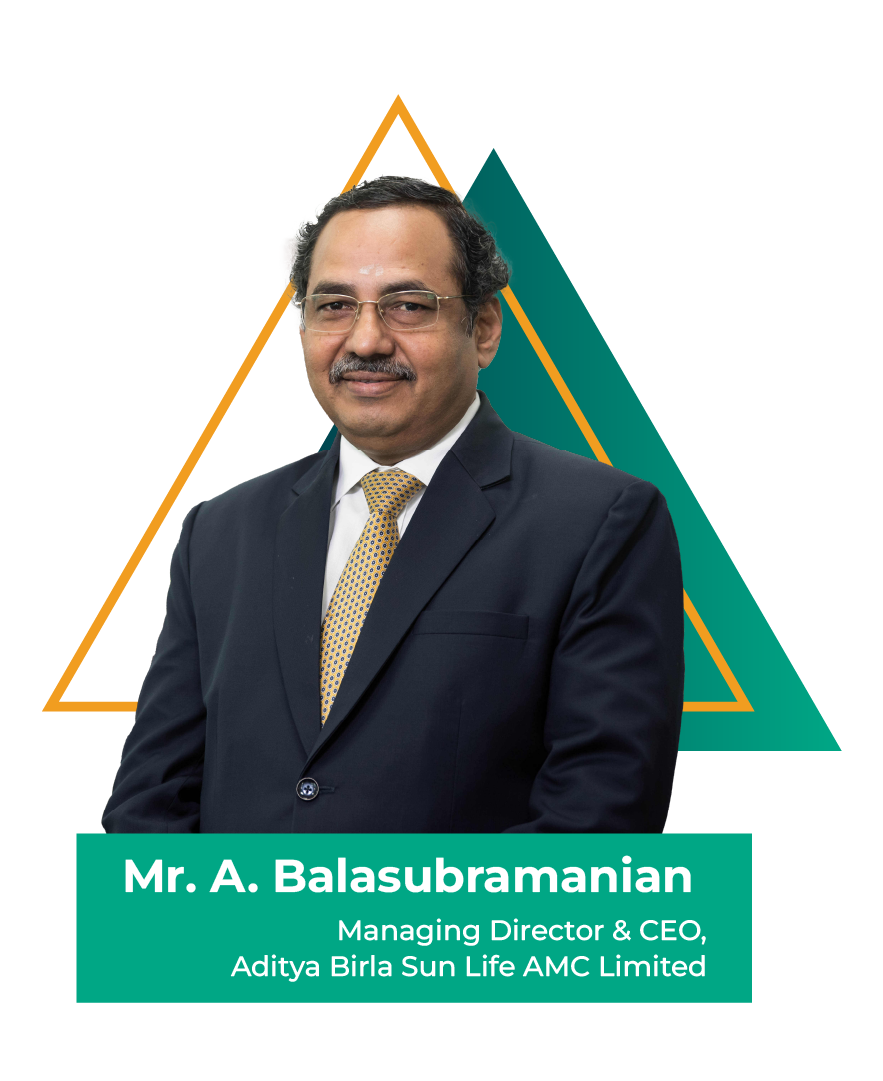

Mr. A Balasubramanian Managing Director & CEO, Aditya Birla Sun Life AMC Limited

A stalwart of the mutual fund industry, Mr. Balasubramanian brings with him over three decades of rich experience.

He oversees assets over Rs. 4 lakh crore including alternate business at Aditya Birla Sun Life AMC. Before joining ABSLAMC in the year 1994, he worked with GIC Mutual Fund, Can Bank Financial Services and Pandit & Co. between 1989 and 1994.

He is closely associated with key industry bodies and has been on the board of AMFI (Association of Mutual Funds in India) since 2009. He has been the Vice-Chairman and Chairman of AMFI, and also the Chairman of AMFI Equity CIOs’ Committee.

He is also an esteemed member of the Fund Management Advisory Committee of the International Financial Services Centres Authority (IFSCA). He has been the Governor on Board of Governors at the National Institute of Securities Markets (NISM), an institute affiliated with SEBI, from 2018 to 2024. He was also a member of the Advisory Committee of the SEBI Investor Protection and Education Fund (IPEF) for a period of five years 2019 – 2024. He has been appointed on 14th October 2024, as an Additional Director on the Board of Bombay Chamber of Commerce & Industry for the year 2024-25.

Mr. Neeraj Choksi is the co-founder and promoter of NJ Group of companies since 1994. He graduated in business management from Sardar Patel University in 1992. Mr. Neeraj has a rich and diverse experience of nearly 30 years in the financial services industry and has been instrumental in establishing the diverse businesses of NJ Group. Mr. Neeraj has also been contributing to the cause of the mutual fund distributors on various forums. He served as a member of SEBI's mutual fund advisory committee for seven years (2011-2018) and again in 2021 as the sole voice of the distribution community. He is also a member of the CDSL Business Advisory Committee & BSE Capital Market Committee.

Mr.Gautam Mehra Partner,Pricewaterhousecoopers Professional Services LLP, India

Gautam qualified as a Chartered Accountant in 1987 and had stints with two leading accounting and tax consultancy firms, which was followed by a long association of over 12 years with an independent practice founded by him. He joined PwC as a Partner in September 2003, and since then has held various roles including leading the India Tax and Regulatory practice between July 2015 and December 2020, prior to which he was leading the Tax and Regulatory practice in Western India and the Financial Services’ Tax and Regulatory group. He was also the Asset Management Sector leader for PwC in India. He presently leads the PwC global relationship for one of India’s largest conglomerates.

Over the years, Gautam has been working with multinational and domestic clients across a wide spectrum of services and has varied experience of over 30 years spanning multiple sectors.

Gautam is presently a member of SEBI’s Alternative Investment Policy Advisory Committee as well as of the SEBI HySec Committee dealing with REITs and InvITs. He is a Board member of the India Chapter of APREA, a regional Real Assets Industry Body and a member of the CII Committee on Private Equity. He has been a member of the American Chamber of Commerce, the National Direct Tax Committee of the Confederation of Indian Industry, as well as of the Expert Advisory Committee of the Institute of Chartered Accountants of India.

Gautam holds a postgraduate degree in law and financial management and is also a member of the Institute of Chartered Accountants of India.

Anthony has been part of the investment management Industry for close to three decades. Currently serving as the Managing Director & Chief Executive Officer, at Mahindra Manulife Investment Management, he also holds the position of Vice Chairman at AMFI (Association of Mutual Funds in India).

Prior to this, he has worked in leadership roles at Morgan Stanley , HSBC and Aditya Birla Sunlife amongst others. Anthony is a graduate from Mumbai University and a Chartered Accountant.

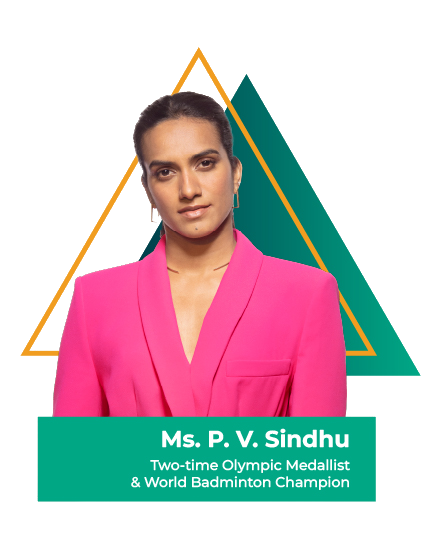

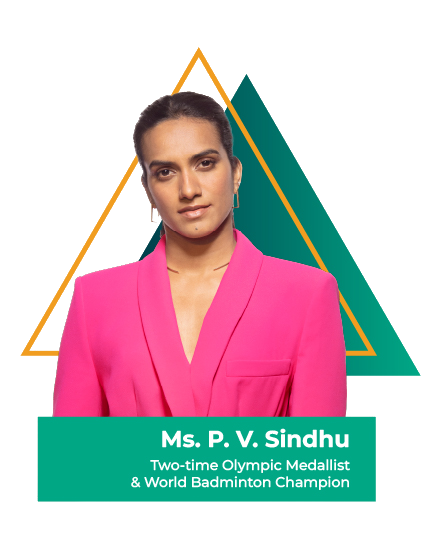

P.V. Sindhu – Indian Badminton Icon & Olympic Champion

P.V. Sindhu is one of India's most celebrated badminton players, known for her unwavering determination, exceptional skill, and historic achievements on the global stage. She has etched her name in sporting history as the first Indian woman to win two Olympic medals and remains a dominant force in international badminton.

Key Achievements:

Double Olympic Medalist: Sindhu won a silver medal at the 2016 Rio Olympics, becoming the first Indian woman to achieve this feat in badminton. She followed it up with a bronze at the 2020 Tokyo Olympics, further cementing her legacy.

World Champion: She became the first Indian to win a gold medal at the BWF World Championships in 2019, showcasing her dominance in the sport.

BWF World Tour Finals Winner: She claimed victory at the 2018 BWF World Tour Finals, joining an elite group of champions.

Asian & Commonwealth Games Medals: Sindhu has earned multiple medals at the Commonwealth Games and Asian Games, including a gold in women’s singles at the 2022 Commonwealth Games.

A recipient of Padma Bhushan and Padma Shri, India’s third-highest and fourth-highest civilian awards and highest sporting honours, including the Arjuna Award and Khel Ratna Award, P.V. Sindhu continues to inspire millions with her perseverance and passion for the sport. She embodies resilience, excellence, and the spirit of Indian sportsmanship.